Ryanair’s CEO Michael O’Leary has long been one of my most admired businessmen. His achievements speak for themselves, but what has always impressed me even more is the consistency of his communication and the clarity of the philosophy that underpins everything he does.

Ryanair’s CEO Michael O’Leary has long been one of my most admired businessmen. His achievements speak for themselves, but what has always impressed me even more is the consistency of his communication and the clarity of the philosophy that underpins everything he does.

O’Leary never wavers. He never dilutes his message. Every interview, every press question, every throwaway comment—he’s hammering home the same point: keep costs low, run tight, and don’t pretend to be something you’re not. He has essentially cloned himself into a corporate entity, crafting a pugnacious and brash airline that mirrors his own combative nature and provocative disregard for the status quo.

I met him once, one-on-one, and despite the famously sharp public image, he was remarkably courteous. People who’ve worked with him echo that impression: behind the bluster and profanity is someone family-oriented, grounded, and genuinely pleasant to deal with, even if he stays tough as nails in business. That mix of discipline, bluntness, cunning, and unexpected warmth is exactly what I’ve always respected about him.

This week’s confrontation with Elon Musk only reinforced all of that. What began as a disagreement about Starlink has already turned into one of the most entertaining corporate feuds of the moment, and O’Leary has turned every bit of it into a masterclass in opportunistic publicity.

It started when O’Leary called Musk an “idiot” during a Newstalk interview, explaining why Ryanair won’t be installing Starlink on its planes. His reasoning was pure Ryanair: the equipment would cost €200–€250 million, add weight, burn more fuel, and provide a service passengers don’t actually want to pay for. On a ninety-minute flight, most travelers are thinking about their holiday, not paying extra to check email. And even for those who might want Wi-Fi, the hassle of setting up payment for an hour of browsing hardly seems worthwhile.

This Frugality Is Classic Ryanair

Ryanair has always understood something fundamental about its passengers: the vast majority simply want to get from A to B cheaply, quickly, and safely. Everything else is secondary. With that understanding, the airline became remarkably adept at turning negative publicity into an asset. As long as headlines didn’t question the cheap fares, turnaround times, or safety, they caused no real damage to the brand—often they actually helped.

Endless articles painting Ryanair as ruthless, miserly, or cold-hearted kept its name circulating and, more importantly, reinforced a single underlying idea: this airline cuts every possible cost and passes the savings to passengers. The public absorbed that message, consciously or not. Outrage over Ryanair’s latest supposed scandal often faded within hours—only for the same critics to find themselves browsing its website the next day, hunting for the cheapest flight they could find.

So when Musk fired back online this week, calling O’Leary an “utter idiot,” the situation was practically a gift. While Musk vented on X and teased a potential buyout—polling his followers on whether he should “restore Ryan as their rightful ruler” by taking over the company—O’Leary did what he does best: he turned the noise into marketing gold. Ryanair launched its “Big Idiot Seat Sale,” a flash promotion that mocked the feud while offering tens of thousands of seats for under €17. Millions of subscribers received emails featuring caricatures of both men perched on a plinth labeled “Big Idiots,” and the airline’s social media team gleefully encouraged customers to “thank that big IDIOT @elonmusk” for the cheap fares. It was classic Ryanair—irreverent, self-aware, and ruthlessly effective.

Ryanair Knows a Well-Timed Insult Is the Cheapest Publicity

O’Leary even staged a press conference on Wednesday to address Musk’s latest online outburst—a tirade in which Musk labeled him an “insufferable special-needs chimp.” The spectacle guaranteed cameras would roll and headlines would multiply.

For a man who has built an empire on ruthless efficiency this kind of free global publicity is priceless. Industry observers weren’t surprised; O’Leary has long understood that controversy when met with humor only sharpens Ryanair’s image as the scrappy sharp-tongued champion of low fares.

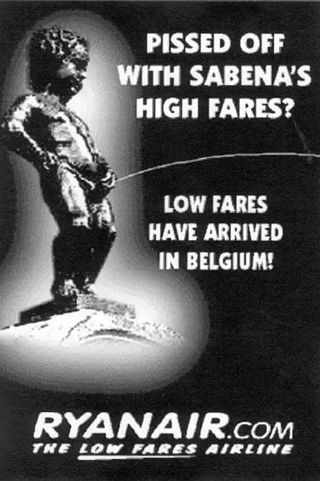

His flair for humorous controversy goes back years. During a 2001 clash with Sabena, Belgium’s then-national carrier, Ryanair ran an ad featuring Brussels’ Manneken Pis statue with the line, “Pissed off with Sabena’s high fares?” Sabena sued and won, forcing an apology—which O’Leary delivered as a gleefully sarcastic “We’re Sooooo Sorry Sabena!” complete with even more fare comparisons. The real masterstroke came outside the Brussels courthouse, where Ryanair had encouraged people to show up, voice their support, and walk away with ultra-low-fare tickets. A massive crowd turned out, turning a legal reprimand into a street-level spectacle. This wasn’t just symbolic; Ryanair had literally set up on-the-ground promotions across Brussels. It was early proof of O’Leary’s formula in perfect sync: humor, provocation, and free publicity feeding off one another.

His flair for humorous controversy goes back years. During a 2001 clash with Sabena, Belgium’s then-national carrier, Ryanair ran an ad featuring Brussels’ Manneken Pis statue with the line, “Pissed off with Sabena’s high fares?” Sabena sued and won, forcing an apology—which O’Leary delivered as a gleefully sarcastic “We’re Sooooo Sorry Sabena!” complete with even more fare comparisons. The real masterstroke came outside the Brussels courthouse, where Ryanair had encouraged people to show up, voice their support, and walk away with ultra-low-fare tickets. A massive crowd turned out, turning a legal reprimand into a street-level spectacle. This wasn’t just symbolic; Ryanair had literally set up on-the-ground promotions across Brussels. It was early proof of O’Leary’s formula in perfect sync: humor, provocation, and free publicity feeding off one another.

The frugality isn’t just marketing—it’s woven into the company’s DNA. A former Ryanair pilot once recalled that the airline used to charge staff for tickets to their own Christmas party, and supposedly not at a discount. He was convinced the company actually turned a profit on the event. It’s the same mindset that drives decisions like rejecting Starlink: if it doesn’t keep fares low, Ryanair won’t pursue it.

In the end, Musk may have satellites, rockets, and a global social media platform, but O’Leary has something more potent in this moment: the ability to turn a petty argument into a worldwide advertisement for Ryanair’s unbeatable prices, reliable service, and no-nonsense approach. The airline emerges from the feud looking cheeky, confident, and completely in control—exactly the way O’Leary prefers it.

The much-whispered

The much-whispered  PepsiCo’s acquisition of probiotic soda brand Poppi and Mexican-American snack label Siete Foods signals a clean-label, culturally conscious

PepsiCo’s acquisition of probiotic soda brand Poppi and Mexican-American snack label Siete Foods signals a clean-label, culturally conscious  In business, every sale may feel like a win, but some sales can actually harm you more than help.

In business, every sale may feel like a win, but some sales can actually harm you more than help..jpg)

.jpg)

.jpg)